Ron Legrand How to Get Rich with Your IRA and Never Pay Taxes, The secret of the ultra rich is revealed to the little guy, and, for once, the less money you have to start with, the better it works!

Dear Friend,

Did you know there’s a secret IRS regulation you can use to get rich without pay taxes on your newly found wealth? Don’t feel left out of the loop if you didn’t because this secret is one most CPAs aren’t even privileged to.

Not only does this “secret regulation” truly exist, but you can also use it to pass your tax-free riches on to your children and grandchildren. No, this isn’t some defiant, tax-protest fantasy or Caribbean offshore scheme designed to cheat the IRS, nor is it some vague loophole the IRS hasn’t yet closed.

All of those things will eventually get you in trouble or eventually land you in jail. What I’m about to reveal to you is perfectly legal, in fact, encouraged by the United States government itself.

My name is Ron LeGrand, and as you may or may not know, I’ve been in the business of teaching people how to get rich in real estate for over 27 years. I’ve bought and sold over 1,600 homes for profits that have made me a millionaire.

There is, however, a problem when you become this successful. When you start making money, especially in real estate, Uncle Sam comes calling, and you have to constantly write him big, fat tax checks, a painful experience at best. I know because I’ve personally written him some big ones over the years. Heck, I’ve probably funded the entire US Congressional payroll.

While I’m a law-abiding citizen and grudgingly pay my taxes on time each year, I’m only interested in paying what’s legally owed and not a cent more. I’m a firm believer in President Eisenhower’s philosophy that it’s the duty of every American to pay no more in taxes than what he or she owes legally.

In my quest to live up to my patriotic duty, I talked to every tax expert under the sun, but no matter which expert I talked to, I always felt like I was overpaying. So I set out on a mission…a mission to discover how I could legally pay the absolute bare minimum in taxes or maybe even no taxes.

I continued to scour the country to find the best minds available to show me how I could legally pay no taxes, and, quite frankly, I didn’t think it could be done until I found one man with the answer I was searching and hoping for. “You really can legally make a fortune and pay no taxes on it. Furthermore, the government actually wants you to do this!”

Back in 1997, Congress, in a rare stroke of genius, passed what they called the “Taxpayer Relief Act.” Hidden in that act was a provision by the then Senate Finance Committee Chairman William Roth that created a new kind of IRA (Individual Retirement Account) designed to encourage more savings among Americans.

Unlike a traditional IRA where you get a tax deduction on the money you contribute and pay taxes when that money comes out, the Roth IRA works just the opposite.

You don’t get a tax deduction on any contribution you make up to $5,500.00 a year depending on your current income; but you also don’t have to pay taxes when you take money out, and it grows tax free inside your IRA.

Here’s the kicker, though, and I want you to pay close attention. I’m about to reveal the HUGE SECRET very few accountants or lawyers have a clue about, and the ones that do have a vested interest in keeping this secret from you…

Here it is: Your Roth IRA can be “self directed.” I realize that at first glance, that secret may not sound like a big deal to most people, but to the smart real estate investor, i.e. the one who follows what I teach, it is a big deal, a HUGE DEAL. One that can effortlessly make you rich!

If you still aren’t jumping out of your seat with excitement like you should be, let me give you an example the “Average Joe” has no clue about. Most people listen to their accountant or financial advisor, as they think they should, and put the money they contribute in their IRA into stocks or mutual funds that grow at wimpy rates of return, or in recent years not at all.

Even if you’re putting away the maximum contribution every year, it takes a long, long time for it to grow into anything substantial, even though it grows tax free when you’re investing in stocks, bonds and mutual funds. Pathetic and irritating, huh?

Who wants to wait around to get rich? Not me and hopefully not you; however, consider the results when your Self-Directed Roth IRA does a real estate deal, following the IRS regulations to the tee:

it makes a tiny investment in a house, I recommend $100, then you turn right around and sell that house, turning a huge profit (the average profit my students make in the “pretty house business” is $35,000.00 by the way).

Since it’s an investment by your IRA, not a personal contribution, that money goes right back into your IRA, TAX FREE, FOREVER.

Think about that for a second…. how many real estate deals like that do you have to do to absolutely flood your IRA with enough tax-free cash for yourself and your family? How many times do you have to invest $100 to make $35,000.00 to pay your children’s and grandchildren’s college tuition? Not many!

In our example, the Average Joe following the advice of his financial advisor invests $100 and, if he’s lucky, gets back $112 in a year, and that’s at a good 12% return rate that is unheard of during this recession and less commissions, of course.

The savvy real estate investor takes that same $100, invests it in a house that doesn’t even require his own money to buy if he does it my way, and gets back $35,000 in only a month or two. Now, THAT’S what I call a return rate!

Now that you know one of my many secrets, think about what you can do when you have real money in your IRA. All of a sudden you can make $100 investments in houses while the cash in your IRA simultaneously grows tax free in other investments at 15%, 25%, or even 30% per year, passively with no extra work on your part.

Would you like to know the step-by-step process to do that? Would you like to know exactly how to stuff your IRA full of tax-free cash on a constant and consistent basis? Would you like to sit back and watch $100,000, $500,000, or even $1 million grow tax free day by day, hour by hour before your very eyes?

Well, you can do all these things when you know the secrets of the Self-Directed Roth IRA, secrets almost no financial professional knows or wants you to know.

Why does your “trusted” financial advisor want to keep this secret from you? The answer is simple. If your IRA is self directed like I suggest, they can’t make any commissions based on trades they make for you.

Utilizing the secrets I know, you get to keep YOUR money, money they were filching from each of your transactions. Your IRA will truly be working for you, not for them. No wonder they want to keep this secret from you!

Now, don’t get me wrong. I don’t want to imply all accountants, lawyers and financial advisors are evil people who are just out to get their hands on your money.

There are many financial professionals who do have your best interests at heart, yet they still encourage you to make low-yield, traditional investments in your IRA because they simply don’t know any better. These Roth IRA secrets are not taught in any accounting program or at any law school or financial institution.

That’s why even CPAs, attorneys and financial advisors keep the money in their own IRAs in stocks, bonds, and mutual funds. It’s the way they were taught by those who came before them, and they simply don’t know any better.

Plus, very few of them are real estate investors, and if they are, they’re the traditional, “buy and hold” crowd, not “transaction engineers” like myself and my successful students.

When you talk to one of these professionals about how to make money buying and selling houses my way, you might as well be speaking a foreign language to them because THEY JUST DON’T GET IT. In fact, it scares them.

Even when you try to patiently explain how your Roth IRA can buy real estate with little or no money, their eyes glaze over, they refuse to listen, and they continue to hold tightly onto the stale methods they find comfortably familiar. It’s so far outside their normal reality, they actively resist what you tell them and do their best to counsel you against it.

Plus, even if you order them to look into it, their financial institutions won’t let them set up a true Self-Directed Roth IRA. At best, what they claim is “self directed” is really multiple choice where you get to choose from three underperforming mutual funds and a pool of low interest, but “safe!”, bonds. They most certainly will NOT let you invest in real estate. You have to find a financial institution that specializes in self-directed IRAs, and not one in ten thousand financial professionals knows where to find one, BUT I DO…

Quite frankly, I only found out about investing in real estate inside a Self-Directed Roth IRA a few years ago myself, and I’ve never taught it before because I wanted to test it out thoroughly and make sure what my experts told me was really true and could work for my students. IT IS, AND IT WILL!

In order to share this opportunity, I decided to team up with the world’s foremost expert on Self-Directed Roth IRAs, the man who found this “secret IRS regulation” for me, and reveal these IRA Wealth Secrets to a few select people via a once-in-a-lifetime seminar.

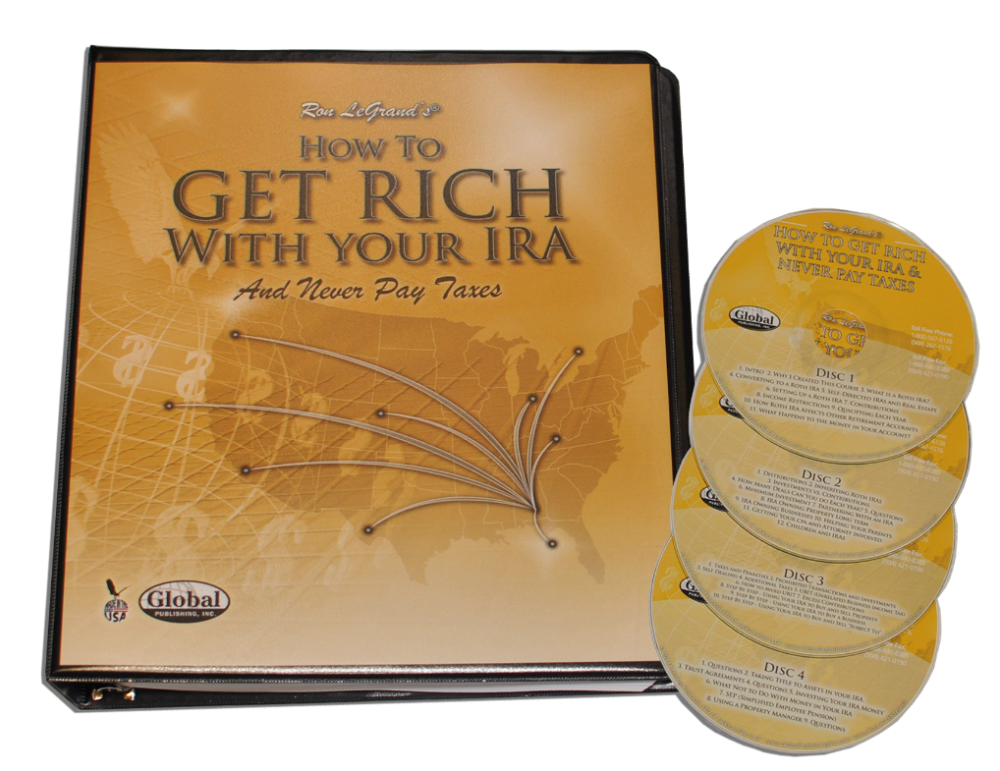

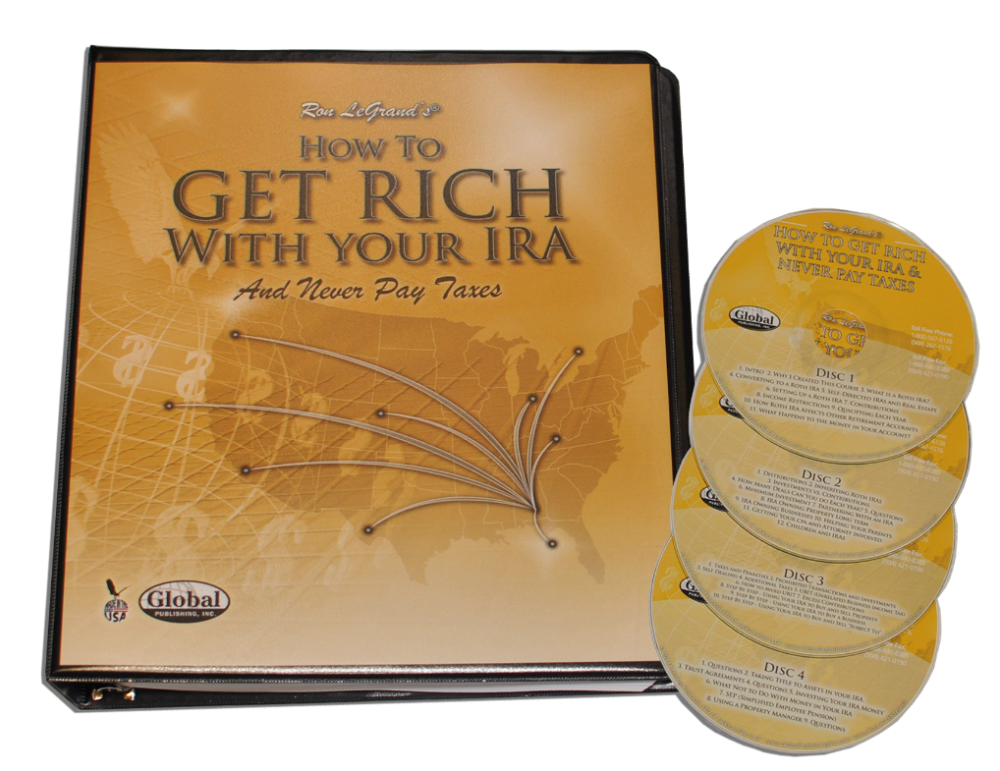

Unfortunately for you, I’ve already put on this riveting seminar, and you missed out. However, there is good news… I recorded the entire seminar, and now, for the first time, my new “How to Get Rich With Your IRA and Never Pay Taxes” seminar is available on CD.

Before I get into the exciting details about my “How to Get Rich With Your IRA and Never Pay Taxes” seminar and the amazing product created from it, I want to tell you just a bit about my good friend, “Mr. X.” He truly is the world’s foremost expert on Self-Directed Roth IRAs. Mr. X has been involved in the securities industry for more than 35 years, and he’s currently Chairman of the Board for a financial institution that specializes in self-directed IRAs which is the custodian for over 20,000 Self-Directed IRA accounts, many of which are valued in the multi-millions.

My own Self-Directed Roth IRA is with Mr. X, as is my daughter’s and many of my students. Mr. X, who’s been written about in Money magazine, understands my kind of real estate investing, and in fact, is a real estate investor himself. Like I said, he’s the guy who first let me in on the fact that I could buy and sell real estate at huge profits inside my Roth IRA using very little money. That’s why I asked him to speak at this seminar with me.

Here are the little-known, tax-free wealth secrets Mr. X and I reveal on this amazing five-CD System:

Okay, that’s it. You have just read a detailed description of the tax-free wealth secrets on these CDs and what they can do for you. If you’re at all interested in getting very, very rich, these CDs are a must have, and you can’t get the information on them anywhere else, certainly not from your accountant or financial advisor.

In addition to the five-CD audio system, you also get the 136-page manual I wrote and passed out at the event. Why should you care about this manual?

In addition to covering everything I reveal on the CDs in depth, it also includes all the forms and agreements you need to get set up with a Roth IRA quickly and easily, and show you how to do real estate deals within it so you can make sure the money goes in tax free for life.

All you have to do is fill out the simple forms in this manual, and money that was taxed before will become tax free. And, when you invest in this System now, you also get the following…

Free Gift #1: The exact IRS regulations that show you just why you really can get rich tax free. These regulations cover the Roth IRA, SEPs, Coverdell Educational IRAs, and Health Savings Accounts (HSAs), all of which are entities you can grow tax-free wealth in. With this manual you’ll have the letter of the law on your side, and you can take comfort in knowing your tax-free wealth is perfectly legal. I call it your “shut up” book, because we refer to it regularly on the CDs to cite the law in case you need to show it to your CPA or other advisor who wants to challenge your use of your IRA from a position of ignorance.

Free Gift #2: Proven Wealth Building Secrets Manual by “Mr. X.” As you recall, he’s the guy who showed me all the tax-free wealth secrets and the #1 IRA Expert in the country. In fact, his company is the one I use to administer all my IRAs, and he can get you set up with your own Self-Directed IRA, just like me. In this easy to understand manual, Mr. X reveals every secret there is to using all the IRA entities to build permanent and lasting wealth for you and your family, plus he provides you all the forms you need to get your Self-Directed IRA set up with his company, just like me. His company makes it so easy to get correctly set up with whatever IRA you choose. They literally do it all for you, and this manual shows you step by step how to get started. This $49.00 value is yours FREE when you order now.

Now, unlike many publishers, I take pride in how my product looks. Your studio-quality recorded CDs will arrive speedily in professional packaging and ready for you to use.

By now you’re probably asking yourself, “OK, Ron, how much is this System going to cost me?” First of all, you shouldn’t be thinking in terms of cost, you should be thinking investment. How much is it worth to you to know how to use your IRA to get rich and never pay taxes?

I can assure you, millions, literally. How much will it cost you if you don’t have this information? Again, the answer is millions.

Think once again about our earlier example about doing one deal inside your Roth IRA versus that same deal done outside of it. Within a Roth, you can turn a house over instantly, keep all $35,000 profit, and immediately put that money to work to make more money within your Roth.

Outside your Roth, you won’t get neat the same rate of return, and if you could, the least you’ll pay in taxes is $5,250.00 (if you hold it for a year and count the profit as a capital gain). If you turn it over immediately you may pay as much as $12,250.00 if you’re in the top bracket of income tax payers.

All it takes to do a deal inside your Roth IRA is a few simple pieces of paper, but those pieces of paper are, obviously, worth thousands.

To be blunt with you, there really is nowhere else you can go to discover these secrets. Accountants don’t know them, lawyers don’t know them, and financial advisors don’t know them or if they do, they don’t want YOU to know them. It took me, even with my many connections across the county, a long time and lots of money to discover them on my own.

So, to save you the trouble and money and get you started on your way to tax-free millions, I’m going to charge you a fair price, not an exorbitant one. At first, I thought about charging the minimum you’d save in taxes on an average “pretty house” deal, $5,250. Now, while I do think that is a very fair investment, I’m not going to charge you that much, or anywhere near that much.

In fact, the investment for my How to Get Rich with Your IRA and Never Pay Taxes System is only $497, much less than you’ll save in taxes on just one, tiny deal within your IRA. BUT, when you order online now, I’ll give you a fast action discount of $200, bringing your investment down to only $297, an instant 40% savings.

Plus, you should also know my System also comes with a…

There are no reviews yet.

You must be <a href="https://wislibrary.org/my-account/">logged in</a> to post a review.