I worked as a professional Futures trader for over 20 years at the following firms: JP Morgan, Commerzbank, Cargill, EDF Man and Dean Witter. I was fortunate to learn how the markets work and how to read order flow from some of the best traders in the world.

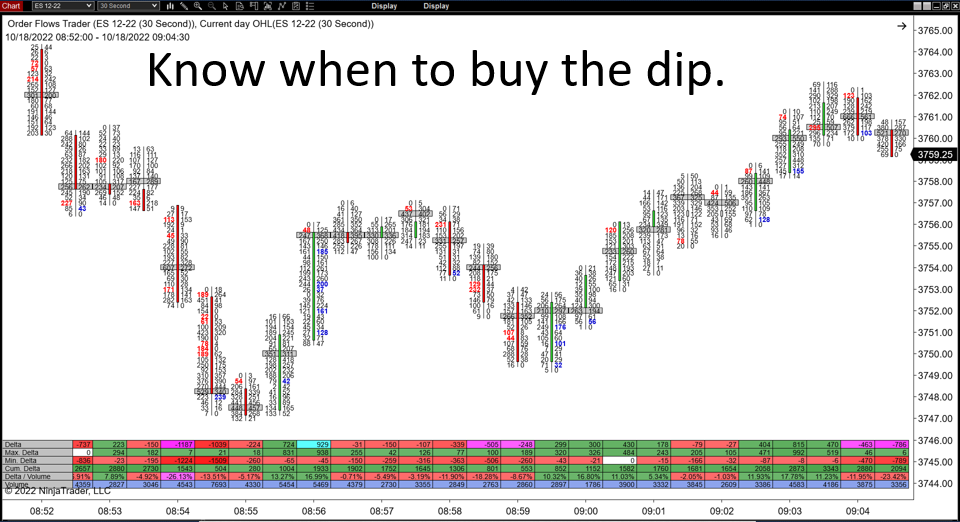

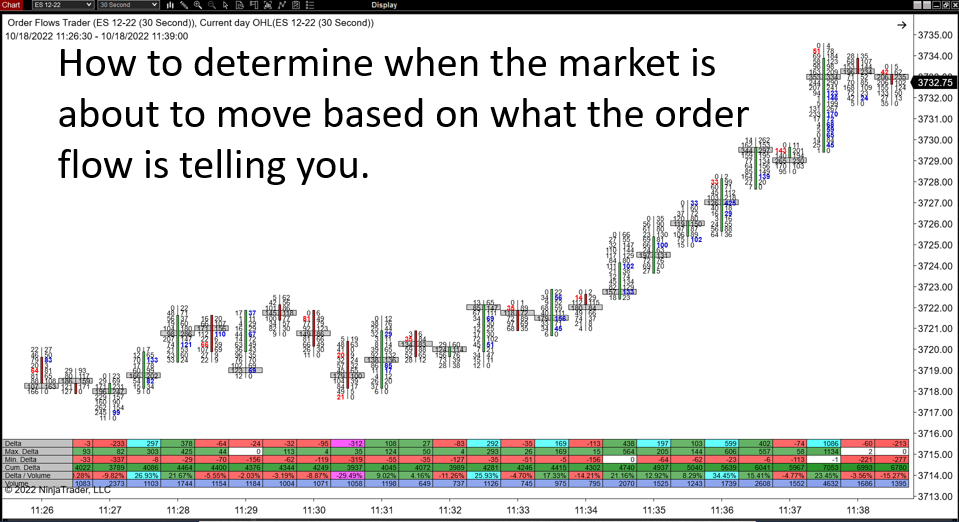

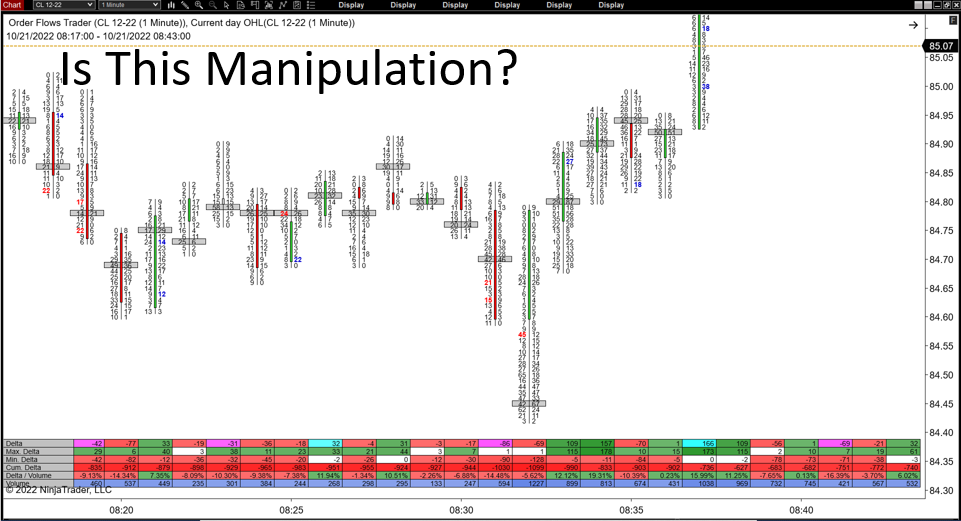

All traders want to get an edge over the competition. They want to find that one thing that will give them an advantage and help them make more money. Unfortunately, the markets are always changing, so it can be difficult to find a reliable edge. However, one thing that remains constant is order flow. By paying attention to order flow, you can get a better sense of where the market is heading and make smarter trading decisions. Order flow tells you who is buying and selling, how much they’re buying or selling, and at what price. It’s a valuable tool that can help you improve your trading and make more money. So if you’re looking for an edge, don’t forget to pay attention to order flow. It just might be the key to your success.

Novice traders come into the markets with the goal of making money all the time. But the reality is that even the best traders have losing trades. The key is to find an approach that matches your personality and risk tolerance. For example, some traders are more comfortable swing trading, which involves holding positions for several days or weeks. Others may prefer day trading, which means opening and closing positions within the same day. And still, others may choose to scalp, which is a very short-term trading strategy that can involve holding a position for just a few minutes. There is no right or wrong way to trade; it all depends on what works for you. But if you want to be successful, you need to have a strong understanding of order flow and risk management. These are the two most important factors that will determine your success or failure in the markets. So if you’re serious about trading, make sure you educate yourself on these concepts and find an approach that suits your needs.

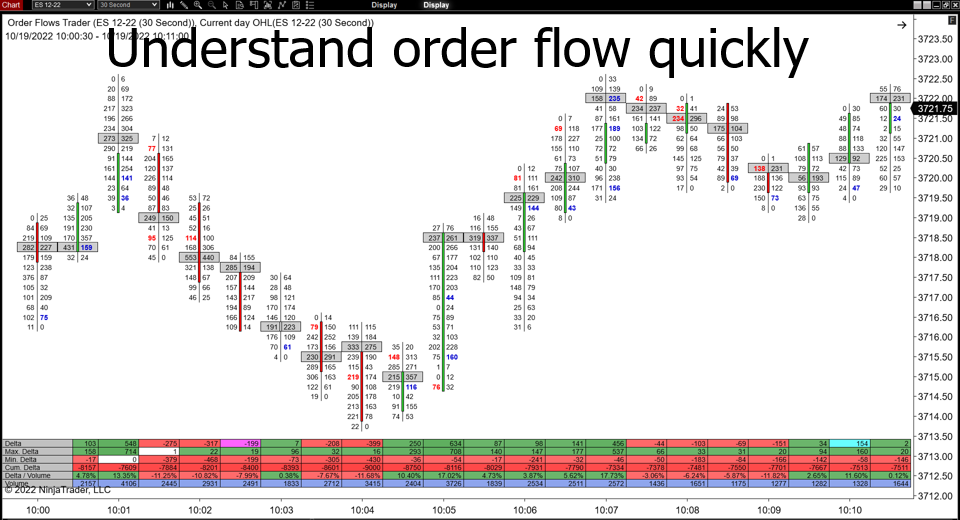

Many traders get frustrated when they try to learn order flow trading. They don’t understand what they are looking at on the screen. They see a lot of different numbers and graphics, but they don’t know how to interpret them. That is why I created Orderflows.com. I wanted to create a resource that would help traders learn about order flow trading and how to apply it to their own trading. I believe that order flow trading is the key to success in the markets, and I want to help as many people as possible learn about it. If you are interested in learning more about order flow trading, then you have to get the Situational Order Flow Trading Course.

There are no reviews yet.

You must be <a href="https://wislibrary.org/my-account/">logged in</a> to post a review.